No products in the cart.

The following data present a unique snapshot into the wood flooring industry: In early 2022, WFB collected responses from wood flooring manufacturers, distributors, retailers and contractors to find out how they did in 2021, what products are being used and how they feel about challenges in the industry. Note that just as we were finishing collecting responses, Russia invaded Ukraine, so any influence of that is not reflected in the following data.—K.M.W.

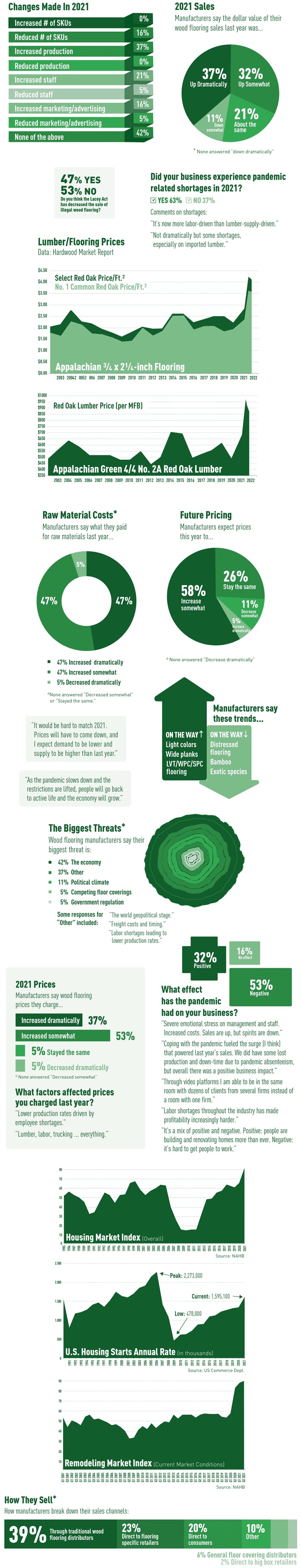

Manufacturers

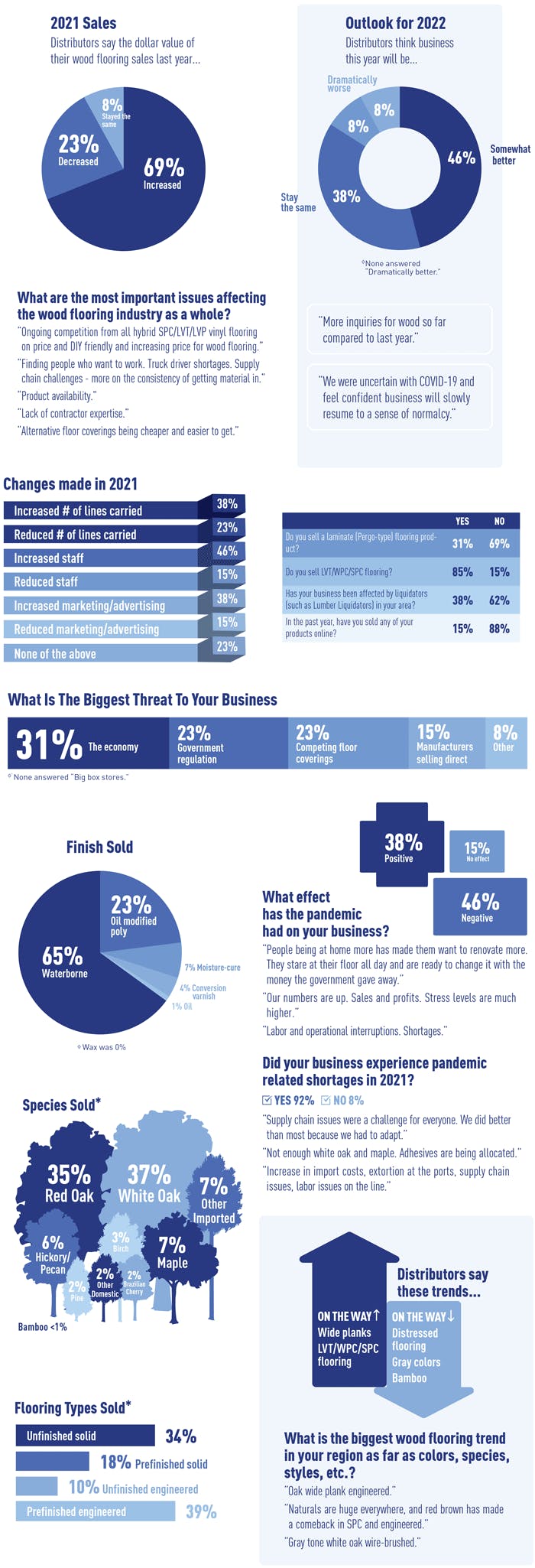

Distributors

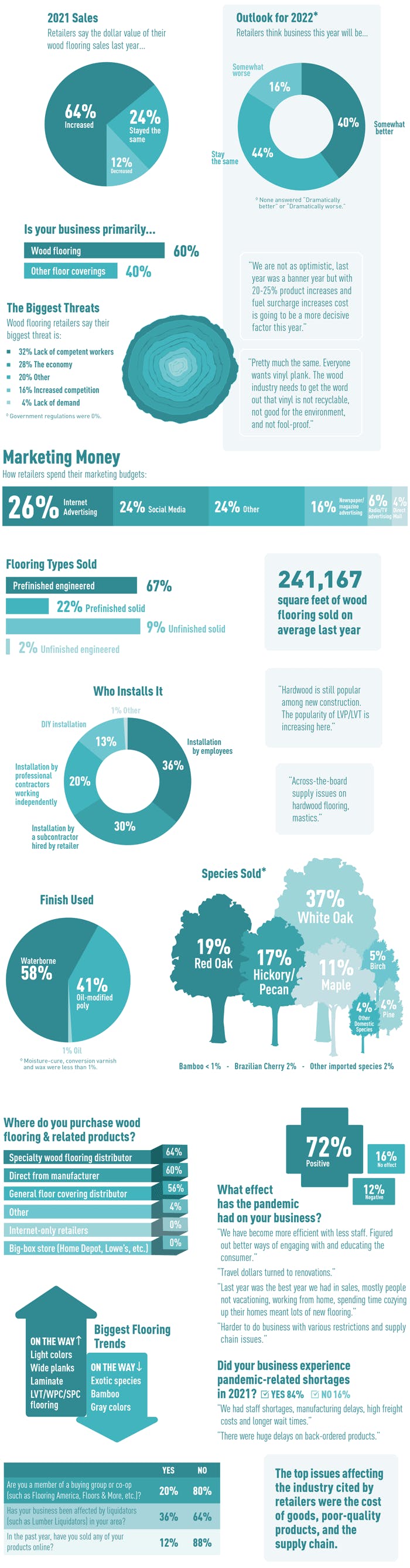

Retailers

Supply chain issues persist two years after pandemic

The past two years since the COVID-19 pandemic, which have seen huge demand for construction materials, as well as huge roadblocks in their availability, have produced all the ingredients for one of the leading issues wood flooring companies say they are facing today: inflation. “Demand was going up while our ability to produce was going down,” says Roy Cox, global product line manager for American Sanders, summing up a situation many industry leaders have been facing.

For many flooring industry chemical and adhesive manufacturers, supply shortages experienced today are the result of a perfect storm that included a pandemic, a labor shortage and a literal storm, as well. When Winter Storm Uri struck Texas in February 2021, it shut down and damaged numerous key manufacturing plants that are heavily relied upon to produce silanes and polyurethanes in the wood flooring industry. “The impact of these long-term outages during a high demand cycle are still being felt today,” says Eric Loferski, director of marketing, Consumer & Construction Business Unit—North America, Bostik Inc.

The shutdowns caused by the catastrophic weather event combined with a surge in demand led domestic manufacturers to look internationally for available raw materials, putting an additional drain on the European markets for polyols and resins, according to David Ford, VP sales and marketing at Stauf, which manufactures its adhesive products in Germany. Urethanes are particularly impacted because of their wide variety of use, Ford notes.

“It used to be that we took roughly five weeks to get a container from Germany to a warehouse [in the U.S.],” says Ford. “At one time, that time frame increased all the way up to six months.”

Those delays seem to be shortening in 2022, however, but are still being felt. For the past four months, the container delays have been trending at about 3–4 month delays, Ford says.

In February 2022, Bostik was able to lift its Force Majeure for its hardwood adhesives, a year after it was declared in 2021. “Demand does continue to outpace supply, but we are now providing far more material to the construction market than one year ago,” Loferski says.

American Sanders has felt the effects on just about every product line it offers, says Cox. Some delays have been easing, but production of semiconductor chips used in electrical machines remains an issue for the company. “There are all of the transportation delays that backed up the supply chain and folks not coming to work at the chip suppliers—they haven’t been able to run at full production,” Cox says.

The strain on resources is also having an impact on creating new prototypes and products.

“All those timelines are so extended now, it extends out how fast we can bring something to the market and how fast we can react after a launch,” Cox says.

For Bona, ocean freight delays caused lead times to double on international shipments.

“From our experience, the ocean market is over capacity driving equipment shortages at the origin,” says Phil Nicolette, Bona’s director of logistics. “Ports at the final destination are overloaded with volume and driving congestion and delays.”

Because of the delays, many companies upped the orders from overseas in order to increase weeks of supply, driving even greater demand into “an already over-capacity mode of transport, further driving up pricing and delays,” Nicolette says.

Impacts on pricing likely to continue through 2022

The shortages and delays have inevitably impacted construction material prices, which surged 20% overall between January 2021 and January 2022. Lumber and plywood prices increased 22.5% year-over-year in February 2022, and architectural coatings prices climbed 20.3%.

“Fluctuations used to be 5-7% in the market, now we’re looking at 25-30%. It’s been huge,” Ford says. “But the ripple effect is plainly and simply that It reverberates all the way down the supply chain.”

Most companies don’t predict current challenges will let up in 2022, as many are still working to catch up with domestic demand. Regarding inflation, Loferski notes there is “very little positive news to reverse that trend.”

“The aggressive government spending during the pandemic has pushed a great deal of money into the market and exacerbated demand, with the annual inflation rate now at a 40-year high of 7.5%,” Loferski says.

Oil, lumber and the Russian invasion of Ukraine

On Feb. 24, Russia, the largest exporter of lumber in the world, launched an invasion of Ukraine, sparking a flurry of Western sanctions designed to pressure the country into calling off its war effort. The U.S., which purchased approximately 3% of its oil from Russia, according to the Wall Street Journal, ceased buying Russian oil, causing oil and gas prices to surge in mid-March. Further sanctions will likely have large ripple effects on the wood flooring industry, which was already facing surging transportation costs and a shortage of drivers, Loferski says.

“As some ingredients for our hardwood adhesives are oil-based derivatives, this will likely push the cost of those ingredients higher,” Loferski adds.

Lumber prices, meanwhile, increased 14% in the weeks following the Russian invasion, climbing to $1,452 per thousand board feet, 15% below the all-time peak in May 2021, according to a report by Markets Insider. On top of the price surges already being experienced, Ken Simonson of the Associated General Contractors of America predicted further price hikes for construction materials as a result of the war in Ukraine, noting metals, fuel and trucking have already been impacted, “while supply chains have become even more snarled.”

Potential sanctions could have major impacts on engineered wood flooring manufacturers who rely on plywood materials from Russia.

“Russian-made plywood or timber is commonly used as core material for engineered hardwoods made in Asia, Europe and the U.S.,” says Brian Carson, president and CEO of Mountville, Pa.-based AHF Products. AHF, one of the largest manufacturers of hardwood flooring, sources its engineered cores primarily from Cambodia and South America, and only a “very small portion” of its cores are sourced from Russia, Carson says.

“The vast majority of our domestic engineered hardwood production use U.S. materials with the capabilities to replace imported core materials,” Carson says. With other options available, AHF is well positioned to weather supply chain disruptions when it comes to Russian-produced plywood, Carson adds, noting that manufacturers “around the world will have to adjust to other options due this supply chain disruption.”

Somerset Hardwood Flooring in Somerset, Ky., buys Baltic birch plywood from different parts of Europe, including Russia, says Paul Stringer, VP sales and marketing. The company’s engineered plant in Crossville, Tenn., will be impacted by potential sanctions and the war, as will all manufacturers who use the high-end Baltic birch plywood material, Stringer says.

“We have enough stock to produce for months to come, but we are aggressively looking at alternative cores and struggling to find both quality and price to match what we are using now,” Stringer says. In the long term, Stringer says the situation will force the company to improve its sourcing and become a better manufacturer to its customers. “Short term,” he says, “it’s not where we want to be.”

“We are committed to maintaining our quality but we are being open minded about where we go from here,” Stringer adds. “Once we figure this out, we will be communicating to our customers what our approach will be and any changes that affect our product line, if any.”

Some suppliers in the flooring industry—such as Välinge Innovation AB—announced they will no longer do business in Russian and Belarusian markets due to the invasion. The Forest Stewardship Council (FSC), furthermore, announced that it would suspend all trading certificates in Russia and Belarus and block all controlled wood sourcing from the two countries as long as the war with Ukraine proceeded.

“All of this has highlighted to us that this is a worldwide supply chain, and right now we don’t know what’s getting ready to happen in the world,” Cox says. “With the events taking place in Europe right now, absolutely we anticipate those are going to have some effect. The hard part is figuring out what those effects are going to be and how significant it’s going to be.”

A potential shift toward more domestic production

The uncertainties of the global market have led some manufacturers to begin looking at additional domestic options for their products, and they predict a bigger industry trend in that direction.

“The purchases from global suppliers increases the transportation cost and forces us to implement price increases to offset,” Loferski says. “Therefore, the interest and demand for domestic ingredient manufacturing is increasing. We anticipate there to be interest in additional domestic capital investment in this area in the near next few years.”

Whereas before American Sanders may have been open to offshore sourcing, the company now takes an increasingly measured approach when considering its supply chain path, Cox says: “It’s not all about costs, necessarily. There are some benefits to having a close source.”

‘Planning ahead’ takes a new level of importance

The past two years have kept industry leaders on their toes. But after an onslaught of unpredictable hurdles, the industry is adapting to the new world and planning ahead to bolster itself to roll with unforeseen punches. “Bona has increased weeks of supply to mitigate risks to our customers,” says Nicolette. “Given what we learned from last year when these supply issues began, we are using what we know to better project for the materials and products we need.”

The changes have caused American Sanders to create a little more tolerance for inventory, according to Cox.

“Before, you wanted to try to run as lean as you can, but when you do that you’re dependent on supply chains, so we’ve learned through this to redefine our definition of ‘lean’ and appreciate a little more those buffer stocks,” Cox says. “I think we’ve learned how to be prepared a little better.”—R.K.

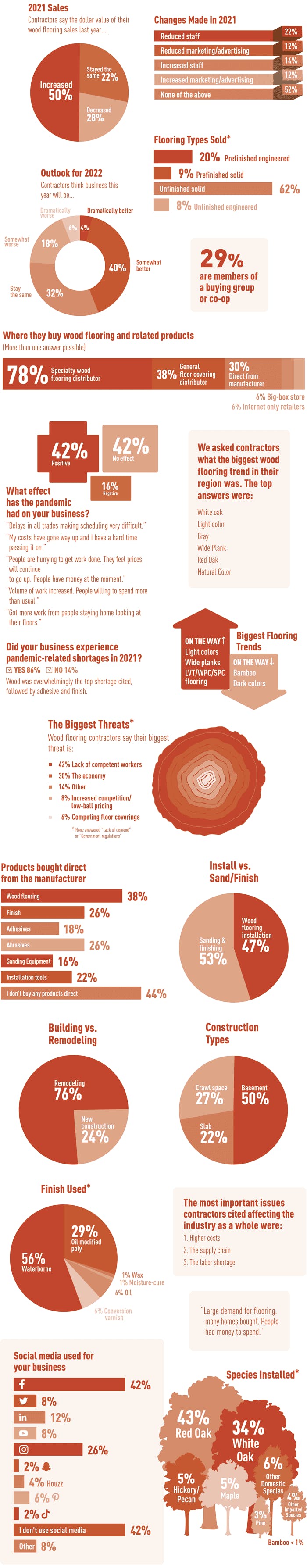

Contractors

See the following previous State of the Industry reports: